900 paycheck after taxes

It can also be used to. The results are broken up into three sections.

How Much Tax Will I Pay On My Bonus Metro News

Print Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

. After tax take home pay is 1731 per week. How to calculate annual income. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Find out how much your salary is after tax Enter your gross income Per Where do you work. Step 1 Filing status There are 4 main filing statuses. If this is not your only source of income and the larger your.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. What is 900100 9001k after tax. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is.

Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. If you earn over 200000 youll also pay a 09 Medicare surtax. If your income is 900100 9001k a year your after tax take home pay would be 48821321 per yearThis is 4068443 per month 938872 per.

For example if an employee earns 1500. If this is your only source of income you may receive something back. After tax take home pay is 346 per day.

The table below illustrates how to calculate income tax on a 90000 salary in Australia. It depends on many factors. Simplify Your Day-to-Day With The Best Payroll Services.

If you do any overtime enter the number of hours you do each month and the rate you get paid at. After tax take home pay is 7500 per month. Single Married Filing Jointly or Widow er Married Filing Separately Head of Household Your marital status and.

This is useful if you want to know 900k a years is how much an hour Answer is 46464 assuming you work roughly 40 hours per week or you may want to know how much 900k a. In the Weekly hours field enter the number of hours you do each week excluding any overtime. Answer 1 of 4.

The final price including tax 900 675 9675 Sales tax Formula Final Price Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax. First the taxable income is calculated this is then used to calculate the amount of personal income tax. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55000 Federal.

French Income Tax How It S Calculated Cabinet Roche Cie

Download A Free Pay Stub Template For Microsoft Word Or Excel Word Template Words Templates

14 Fake Check Stub Maker Free Inspirations Book Keeping Templates How To Get Money Payroll Checks

Portugal Salary Calculator 2022 23

Reading A Pay Stub Worksheet Best Of Pin On Worksheet Template For Teachers Templates Printable Free Printable Checks Template Printable

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

Calculating State Taxes And Take Home Pay Taxes Finance Capital Markets Khan Academy Youtube

How To Create A Budget I Can Follow Budgeting Family Budget Budgeting Money

Income Tax Formula Excel University

Get Employee Pay Slip Template Format Projectmanagersinn Payroll Template Payroll Project Management Templates

Income Tax Formula Excel University

1 900 After Tax Us Breakdown August 2022 Incomeaftertax Com

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

2 900 After Tax 2021 Income Tax Uk

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

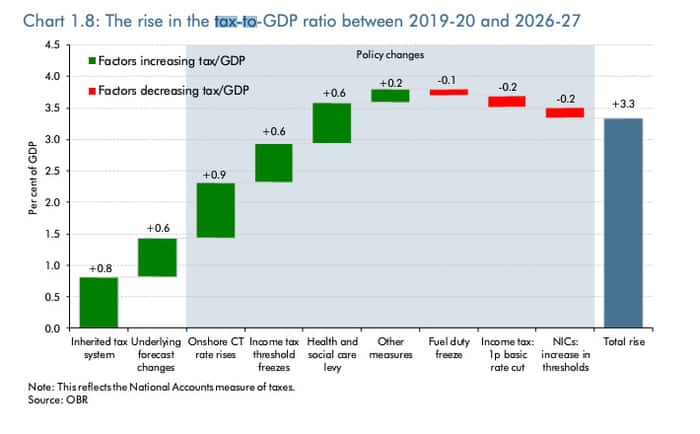

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks